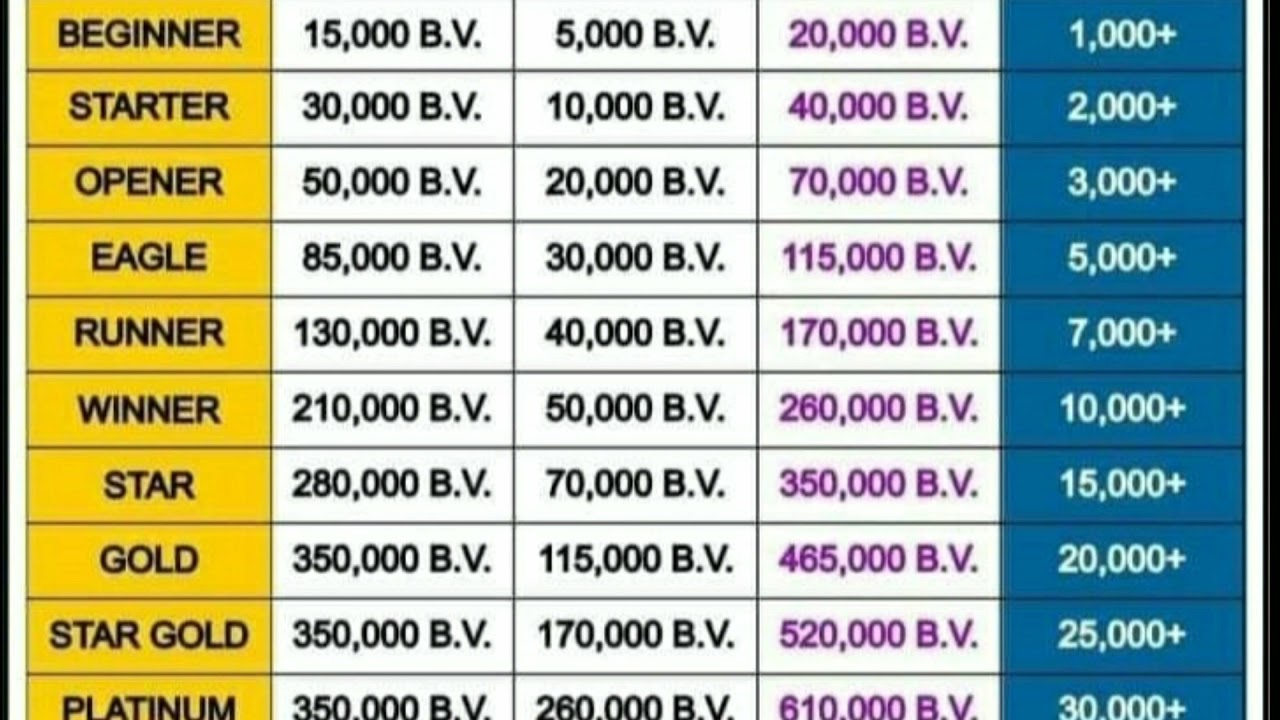

Updated Rcm Chart rcmbusiness rcmpinlevel magicalsupport

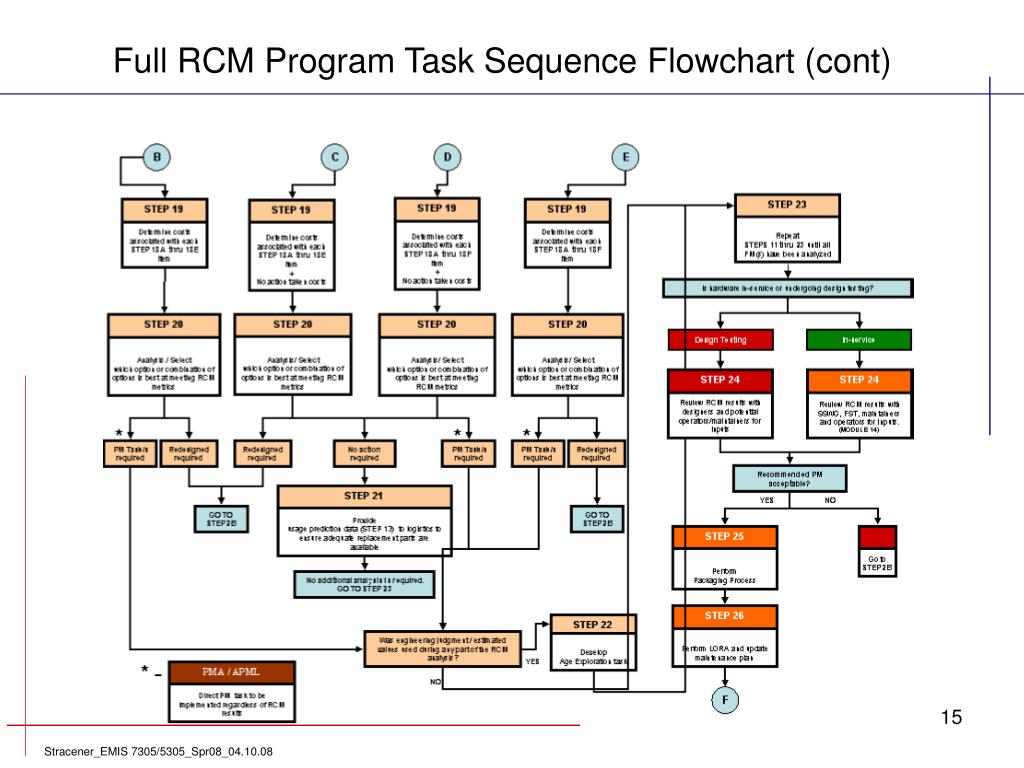

RCM Decision Diagram

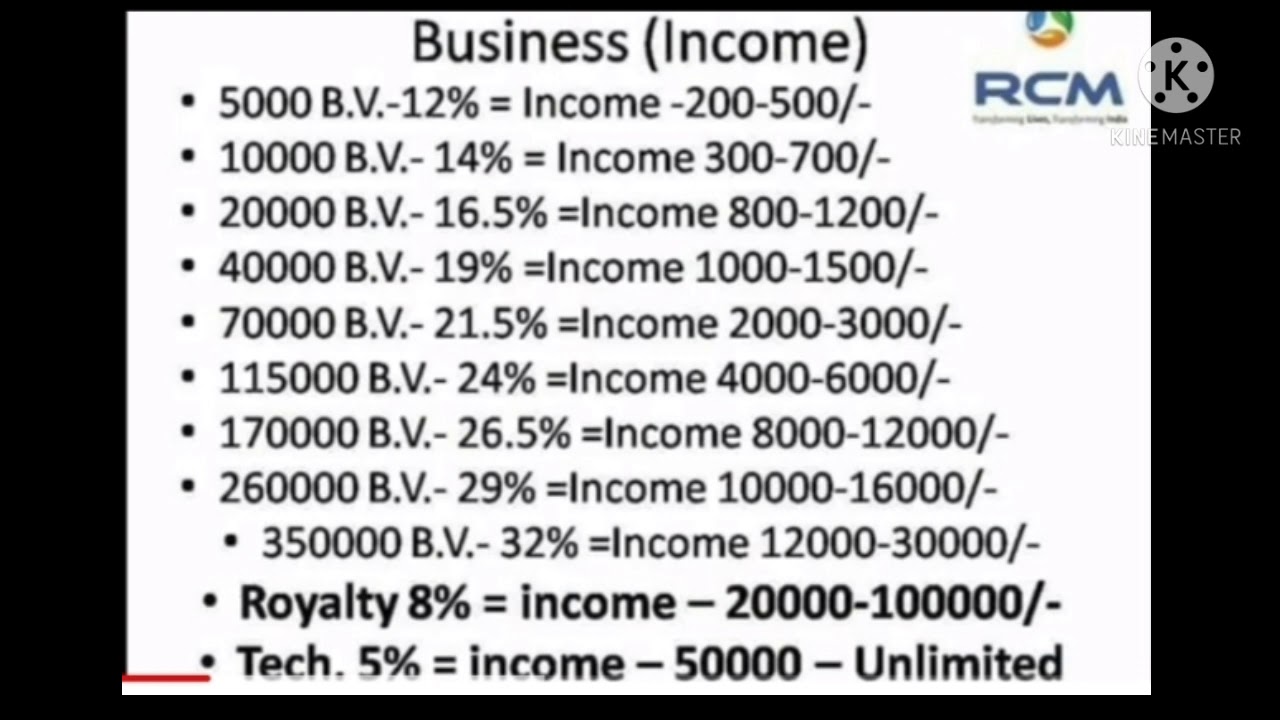

यह Rcm Commission Calculator App आपको आसानी से एकल अनुप्रयोग के साथ Rcm Business Business वॉल्यूम के लिए आवश्यक सभी गणनाओं को आसानी से संभालने की अनुमति देता है।

What is RCM and How Do You Get There? Arora Engineers, Inc.

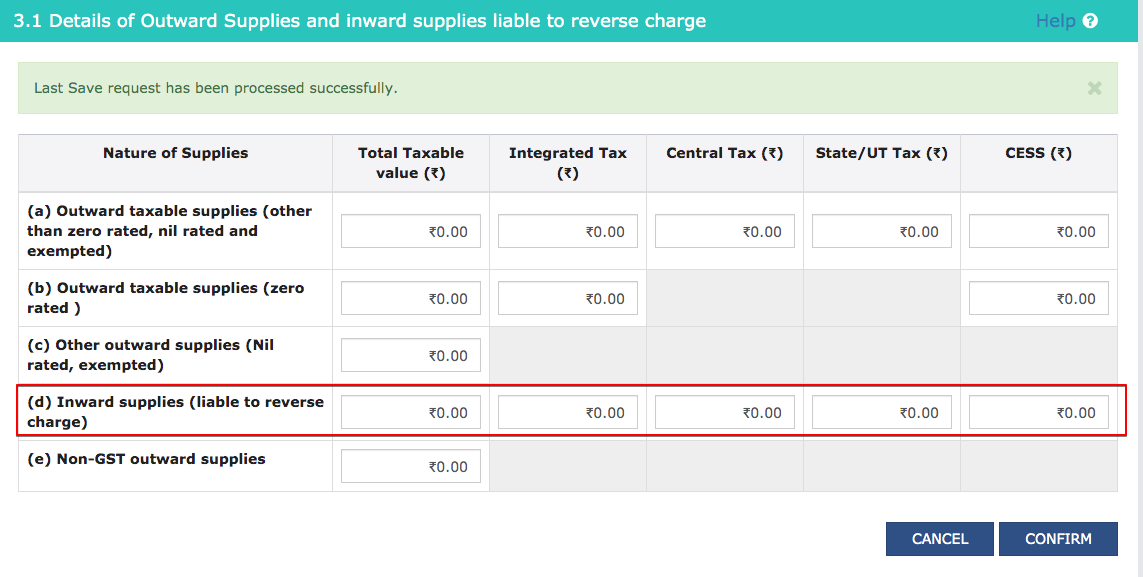

The Reverse Charge Mechanism (RCM) is the process of GST Payment by the receiver instead of the supplier. In this case, the liability of tax payment is transferred to the recipient/receiver instead of the supplier. The Reverse Charge Mechanism is applicable in the case of : Imports Purchase from an unregistered dealer

Updated Rcm Chart rcmbusiness rcmpinlevel magicalsupport

Updated on November 15th, 2023. Reverse Charge Mechanism under GST is a mechanism under which the usual cycle of tax payment is reversed. Under Reverse Charge, the recipient pays to the supplier an amount exclusive of GST, the recipient then pays the GST directly to the Government. RCM is a complex concept that works in select scenarios only. 1.

R1 RCM Inc (RCM) RCM chart

Lotteries (Regulation) Rules, 2010, made under the provisions of sub section 1 of section 11 of the Lotteries (Regulations) Act, 1998 (17 of 1998). 6. Any Chapter. Used vehicles, seized and confiscated goods, old and used goods, waste and scrap. Central Government, State Government, Union territory or a local authority. Any registered person.

RCM Commission Distribution RCM Commission Slab RCM YouTube

RCM Health Care Services partners with health systems, academic medical centers, National Cancer Institutes, and health plans to provide Clinical Data Management, Abstraction, and Registry Services to support the facilitation and use of patient data for research efforts, quality initiatives, regulatory and accreditation purposes.. Our QA, medical record, and manual chart abstraction consulting.

"RCM" में अपना कैसे Calculate करते है rcm business

21 comments As you all aware that the Reverse Charge Mechanism (RCM) under Section 9 (4) is postpone till 30.06.2018. However RCM under section 9 (3) is in existence. I have provided below the List of expenses on which RCM is applicable and ITC available, except some of the Expenses.

» RCM Testing Regulatory Compliance Mark (RCM) EMC Bayswater

(a) The person who pays or is liable to pay freight for the transportation of goods by road in goods carriage, located in the taxable territory shall be treated as the person who receives the service for the purpose of this notification.

RCM chart for Goods & services in GST Reverse charge list for Goods

Throughout the RCM process, healthcare organizations should maintain accurate and comprehensive financial records. Financial reporting and analysis provide insights into the overall revenue performance, identify trends, and help in making informed business decisions. Key performance indicators (KPIs) such as collection rates, days in accounts.

RCM business commission slabs YouTube

The estimated total pay for a RCM Specialist is $76,206 per year in the United States area, with an average salary of $71,044 per year. These numbers represent the median, which is the midpoint of the ranges from our proprietary Total Pay Estimate model and based on salaries collected from our users. The estimated additional pay is $5,162 per year.

RCM chart for services in GST Reverse charge list for services in gst

Contracts of US stocks were little changed after commodity and financial shares drove S&P 500 down on Tuesday. Treasury 10-year yields and the dollar were steady in Asia trading. The yen, which.

PPT Reliability Centered Maintenance (RCM) Analysis PowerPoint

Rcm Commision Calculator Upto 10 Teams New upgraded plan. Total BV: Team 1: Team 2: Team 3: Team 4: Team 5: Team 6: Team 7:

RCM Rate chart for goods in GST Reverse Charge Mechanism (RCM) List

Sohan's = 7600 - A leg + B leg. income. = 7600 - 5400= 2200 rs. 10,000 BV. @14 %. = 1400. 800 rs.

What is RCM in GST, Who is covered & penalty

The fastest growth in healthcare may occur in several segments. We estimate that healthcare profit pools will grow at a 7 percent CAGR, from $583 billion in 2022 to $819 billion in 2027. Profit pools continued under pressure in 2023 due to high inflation rates and labor shortages; however, we expect a recovery beginning in 2024, spurred by.

New RCM Commission Slab 2023 RCM Commission Chart

What is Reverse Charge Mechanism? Typically, the supplier of goods or services pays the tax on supply. Under the reverse charge mechanism, the recipient of goods or services becomes liable to pay the tax, i.e., the chargeability gets reversed.

RCM Starter Pin Level Commission Calculation/Rcm Plan/Royalty

Healthcare revenue cycle management (RCM) is an umbrella term for the multistep process healthcare providers use to identify, manage, and collect revenue. Healthcare revenue cycle management begins the moment a patient schedules an appointment and ends when the provider collects all the reimbursement to which they're entitled.

Rcm Business Royalty Commission Calculation/Rcm Royalty Pin

Complete provisions of Reverse Charge Mechanism (RCM) under GST with updated Chart of Goods and ServicesArticle contains provisions related to Statutory Provision of Reverse Charge Mechanism (RCM) under GST, GST Registration under RCM, Invoicing Rules under RCM, Input Tax Credit under RCM, Liability arises to pay GST under RCM, Time of supply fo.