What is EBITDA Formula, Definition and Explanation

EBITDA dan EBIT Pengertian, Fungsi, dan Cara Menghitung — Stockbit Snips Berita Saham

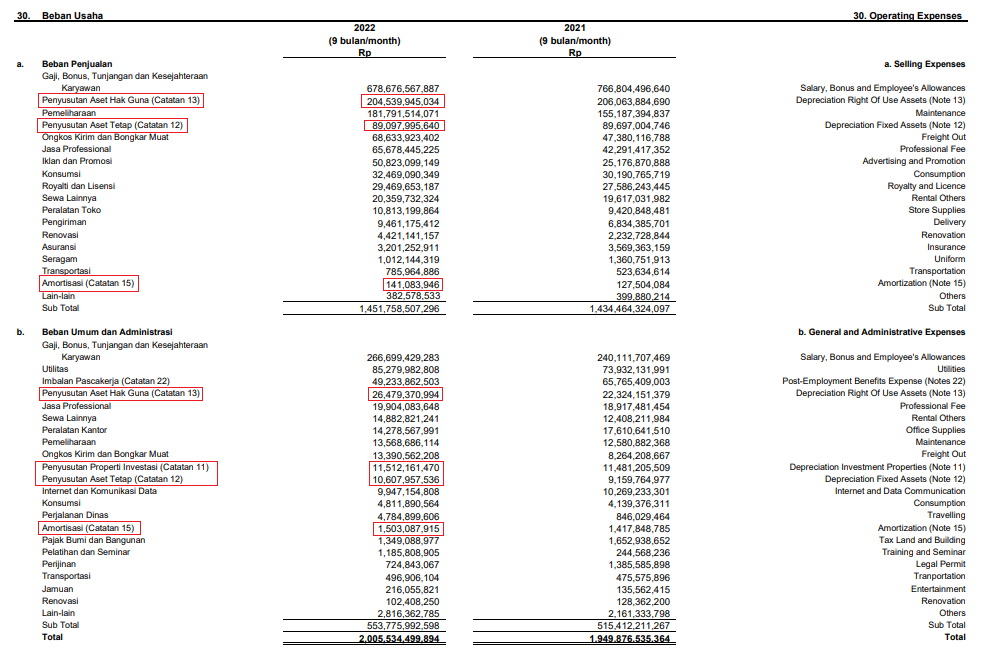

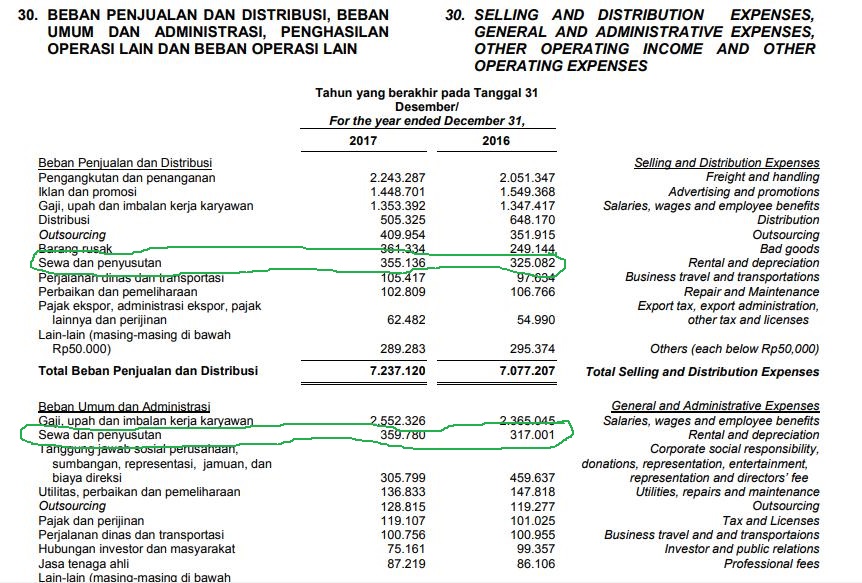

1. Metode Langsung Menghitung EBIT. Berikut ini adalah rumus untuk menghitung metode langsung atau direct method. Penjualan Bersih - Harga Pokok Penjualan - Biaya Operasional. Dalam hal ini, biaya operasional yang dimaksud adalah biaya penjualan, biaya pemasaran, biaya administrasi, dan biaya lainnya yang berhubungan dengan operasional.

Analisis EBITEPS • Nural Learning

Rumus EBIT tidak langsung ini biasanya digunakan untuk menghitung pendapatan total di akhir tahun dengan nilai nyata yang didapat dari biaya bunga dan pajak. Biasanya, nilai EBIT dalam laporan keuangan dari perhitungan dengan rumus tidak langsung diumumkan pada rapat akhir tahun.

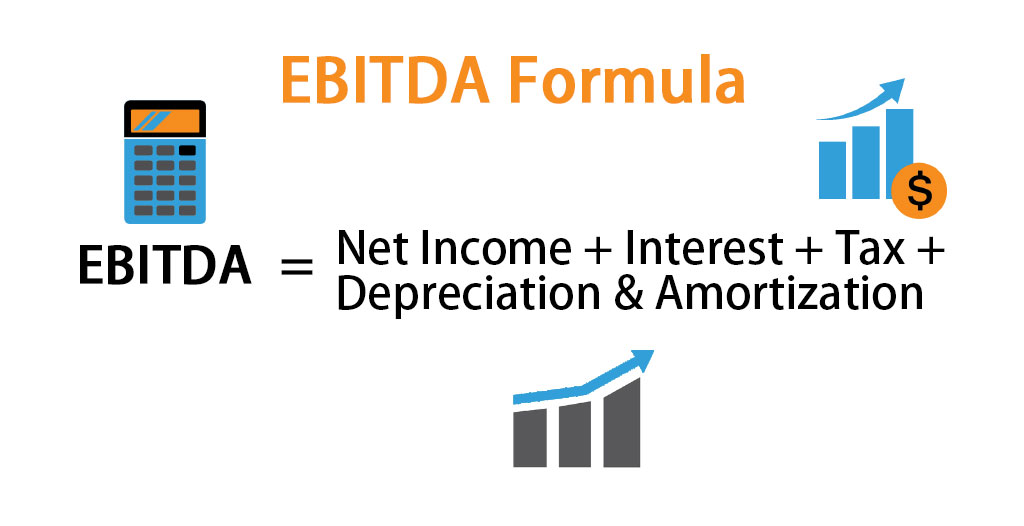

Rumus dan Cara Menghitung EBITDA

EBIT adalah singkatan dari Earnings Before Interest and Taxes, atau dalam Bahasa Indonesia dikenal sebagai pendapatan sebelum bunga dan pajak. Perhitungan EBIT ini umumnya digunakan untuk mengukur pendapatan operasional perusahaan. Untuk menghitung EBIT adalah tugas yang memerlukan ketelitian, karena perlu dilihat dari laporan laba rugi perusahaan.

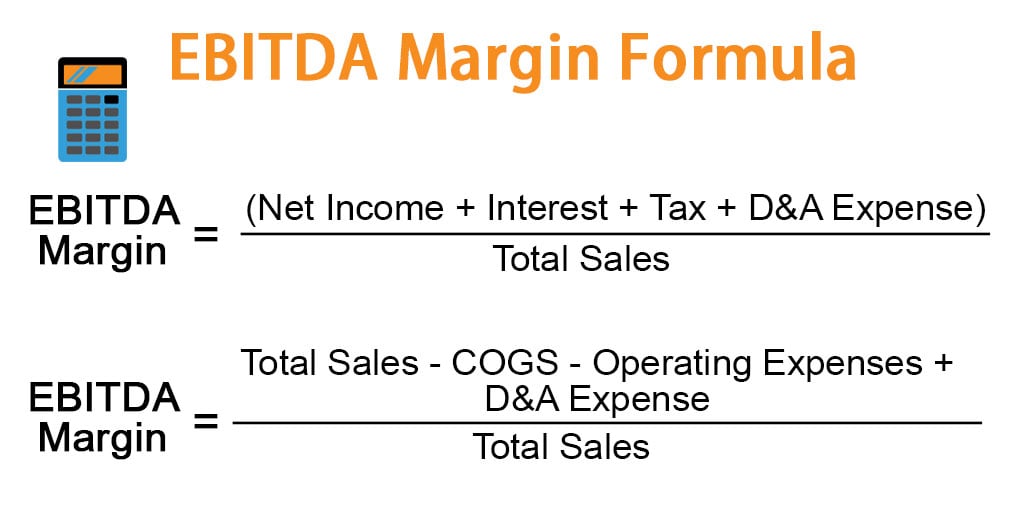

What is EBITDA Margin? Formula + Calculator

EBIT, or the operating income, is the profitability measurement that determines the company's operating profit and is calculated by deducting the cost of the goods sold and the operating expenses incurred by the company from the total revenue. It only shows the amount of profit the company generates from its operating activities.

Earnings Before Interest and Taxes (EBIT) Definition & Formula

EBITDA-To-Interest Coverage Ratio: The EBITDA-to-interest coverage ratio is a ratio that is used to assess a company's financial durability by examining whether it is at least profitably enough to.

Earnings Before Interest and Taxes (EBIT) Calculation

Earnings Before Interest & Tax - EBIT: Earnings Before Interest & Taxes (EBIT) is an indicator of a company's profitability, calculated as revenue minus expenses, excluding tax and interest. EBIT.

How to calculate EBIT? Universal CPA Review

Rumus EBIT tidak langsung ini biasanya digunakan untuk menghitung pendapatan total di akhir tahun dengan nilai nyata yang didapat dari biaya bunga dan pajak. Selain itu, nilai EBIT dalam laporan keuangan dari perhitungan dengan rumus tidak langsung diumumkan pada rapat akhir tahun. Hal ini juga yang membuat nilai dari perhitungan rumus EBIT.

EBITDA Formula Calculator (Examples with Excel Template)

In accounting and finance, earnings before interest and taxes (EBIT) is a measure of a firm's profit that includes all incomes and expenses (operating and non-operating) except interest expenses and income tax expenses.. Operating income and operating profit are sometimes used as a synonym for EBIT when a firm does not have non-operating income and non-operating expenses.

Learn the Formula and Calculation for EBITDA with Examples

Why Use EBIT. Investors use Earnings Before Interest and Taxes for two reasons: (1) it's easy to calculate, and (2) it makes companies easily comparable. #1 - It's very easy to calculate using the income statement, as net income, interest, and taxes are always broken out. #2 - It normalizes earnings for the company's capital structure.

Earnings Before Interest and Taxes (EBIT) Definition and Formula

EBIT formula. Version one: Total revenue - cost of goods sold - operating expenses. This formula is based on the multi-step income statement formula, which is (revenue - cost of sales - operating expenses - non-operating expenses). Here is an explanation of each component of the formula: Revenue includes sales, and other transactions that generate cash inflows, including a gain on.

Apa Itu Ebit Dalam Laporan Keuangan Brain

Earnings Before Interest and Taxes: How to Calculate EBIT. Written by MasterClass. Last updated: Jun 7, 2021 • 4 min read. Earnings before interest and taxes (EBIT) is a particularly useful metric when comparing companies with different capital structures and tax burdens. Earnings before interest and taxes (EBIT) is a particularly useful.

Laba Sebelum Bunga dan Pajak (EBIT) Rumus Perhitungan

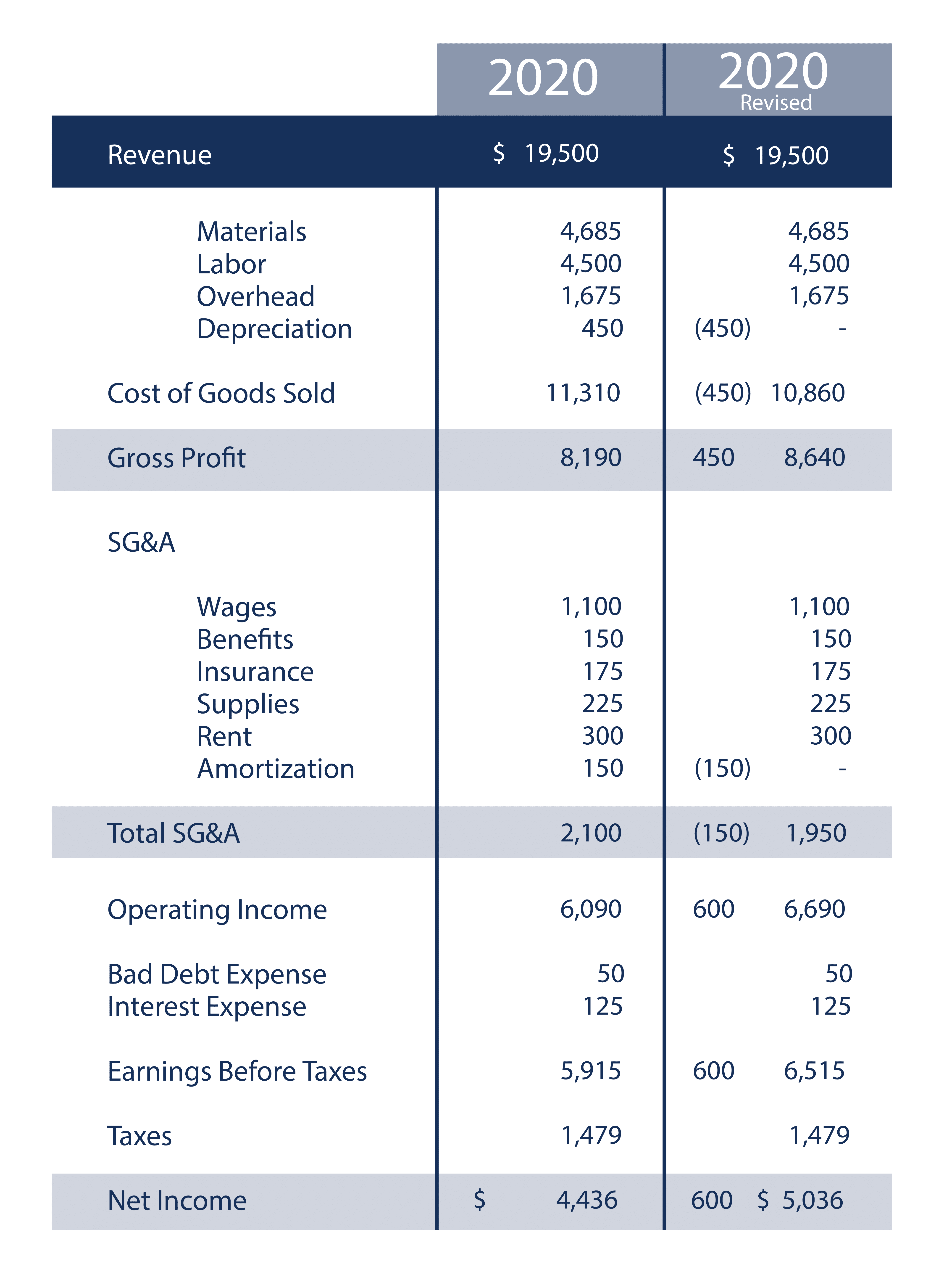

Operating Income = EBIT. Another way to calculate income from operations is to start at the bottom of the income statement at Net Earnings and then add back interest expense and taxes. This is a common method used by analysts to calculate EBIT, which can then be used for valuation in the EV/EBIT ratio. Below is an example calculation of EBIT:

Debt to EBITDA ratio formula and calculation Financial

Berikut adalah dua rumus EBIT: EBIT = Laba Bersih + Bunga + Pajak. EBIT = EBITDA - Beban Penyusutan dan Amortisasi. Dimulai dengan laba bersih dan menambahkan kembali bunga dan pajak adalah yang paling mudah, karena item ini akan selalu ditampilkan pada laporan laba rugi.

EBITDA Margin Formula Example and Calculator with Excel Template

Dengan menggunakan Metode Tidak Langsung, nilai EBIT-nya adalah sebagai berikut: EBIT = Laba Bersih + Pajak + Bunga. EBIT = 300 juta + 45 juta + 200 juta. EBIT = Rp 545.000.000. Dari perhitungan EBIT di atas, dapat disimpulkan bahwa nilai EBIT Perusahaan A adalah sebesar Rp 545 juta.

Analisis dan Perbedaan EBT, EBIT dan EBITDA

EBIT = Penjualan Bersih - Harga Pokok Penjualan (HPP) - Biaya Operasional. Biaya operasional yang dimaksud dapat berupa biaya administrasi, penjualan atau pemasaran, dan lainnya. Sedangkan rumus perhitungan laba sebelum bunga dan pajak atau EBIT menggunakan metode tidak langsung (indirect method) adalah: EBIT = Laba Bersih + Biaya Bunga.

Full EBITDA Guide What is It & How Investors Use It (Formula)

EBIT = Revenue - COGS (cost of goods sold) - Operating expenses. But as you'll see, this is the formula for operating income. Anyway, here's a sample way to calculate EBIT: Net earnings: $1,000,000. Interest expenses: $50,000. Taxes: $450,000. EBIT = net earnings + interest + taxes.